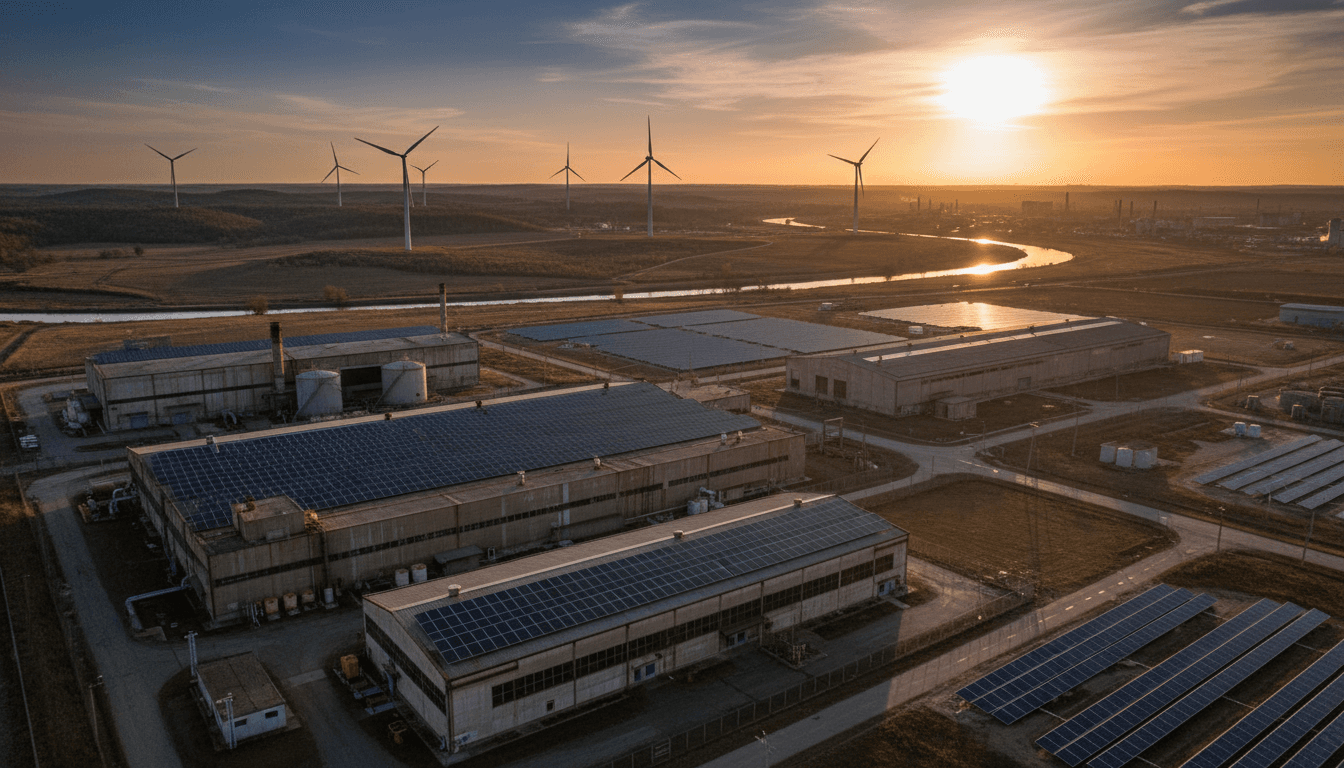

Carbon-Neutral Industrial Platforms Built to Scale

Veridian Global Investments creates and scales transformative businesses across circular economy, advanced recycling, decarbonized infrastructure, and renewable fuels.

How We Build Carbon-Neutral Platforms

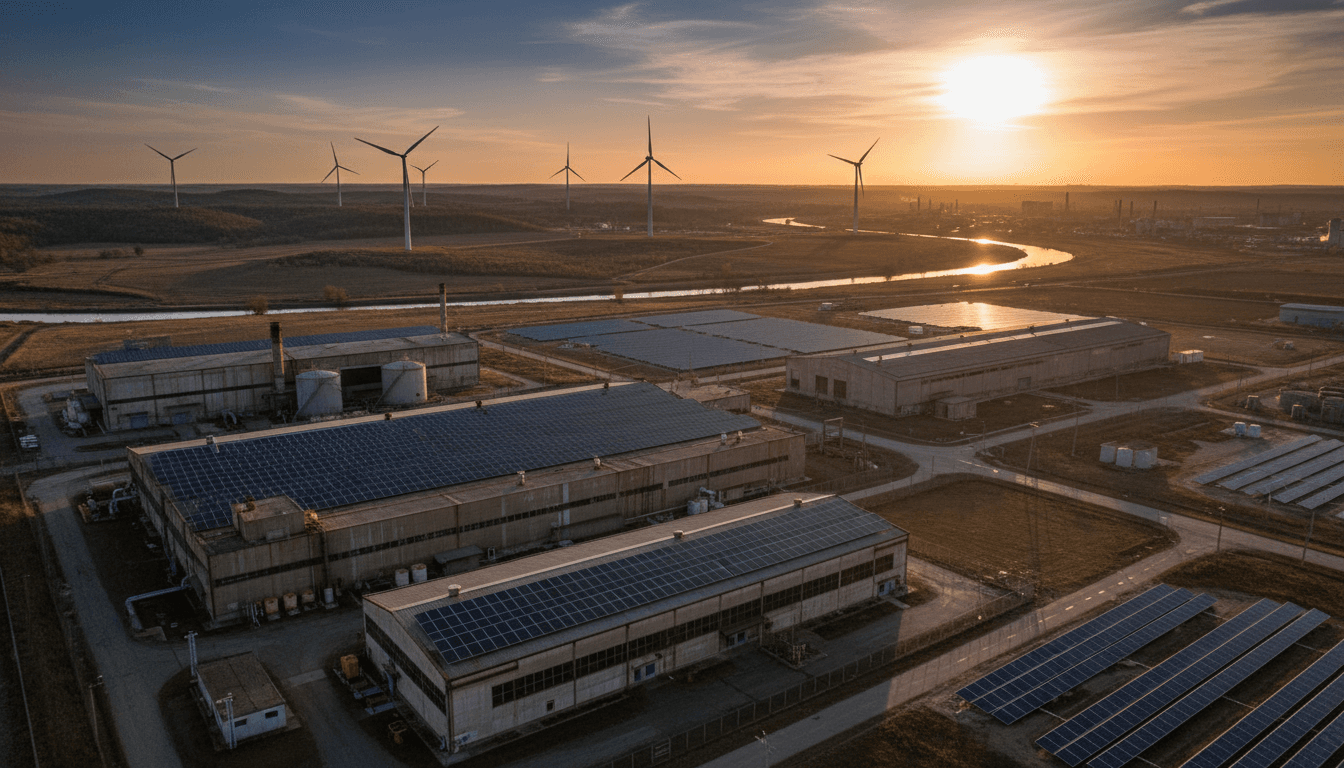

We invest in scalable industrial businesses designed for real impact, regulatory tailwinds, and measurable carbon reduction.

Platform-centric investing

We build scalable businesses, not isolated assets. Each investment generates recurring revenue and measurable environmental impact.

Real assets with real returns

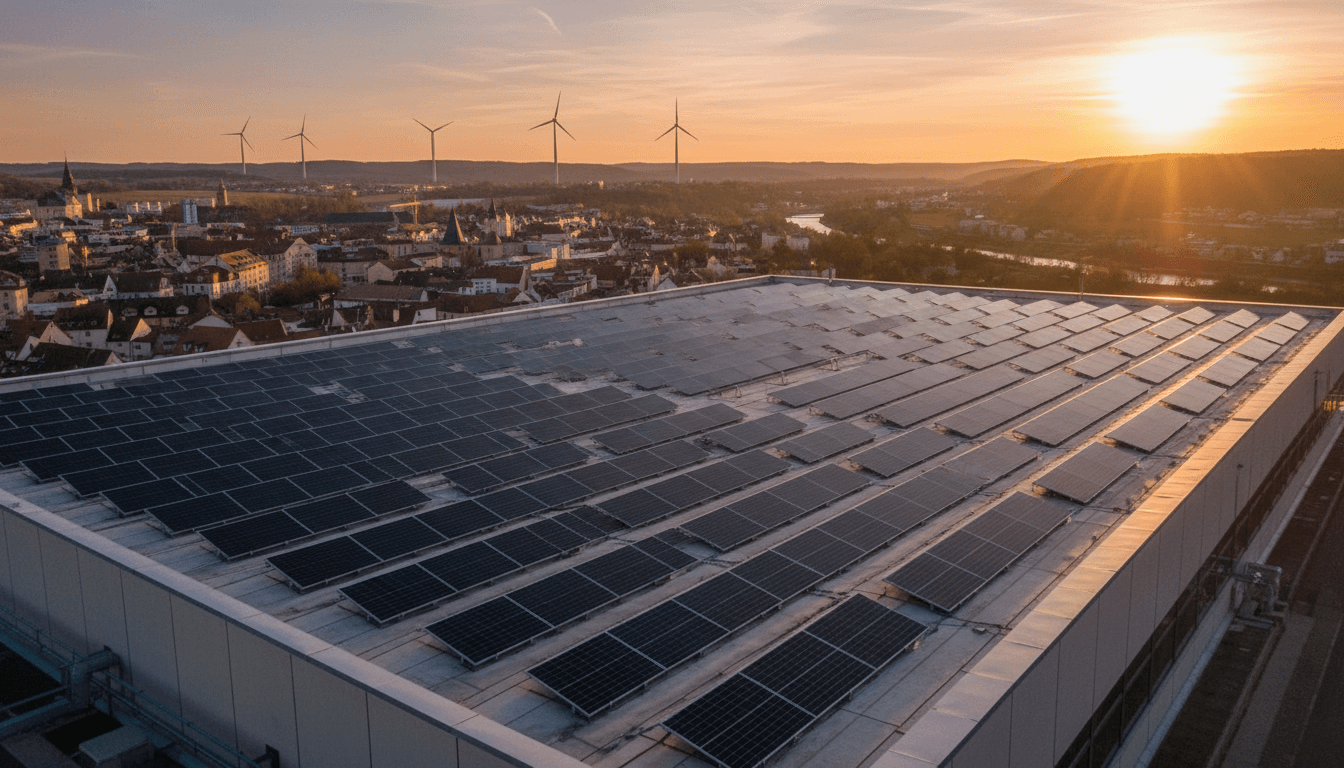

Asset-backed, infrastructure-style investments with contracted revenue, strong regulatory alignment, and verified carbon reduction.

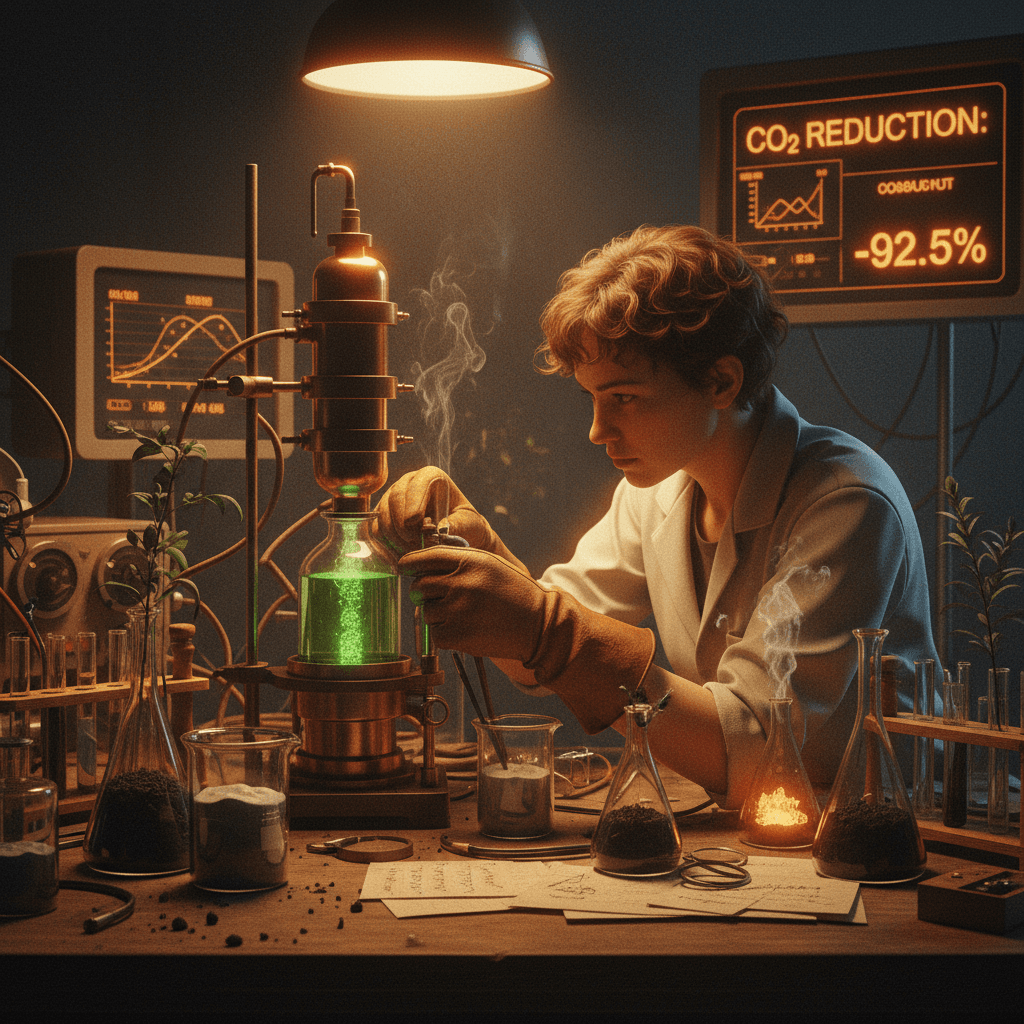

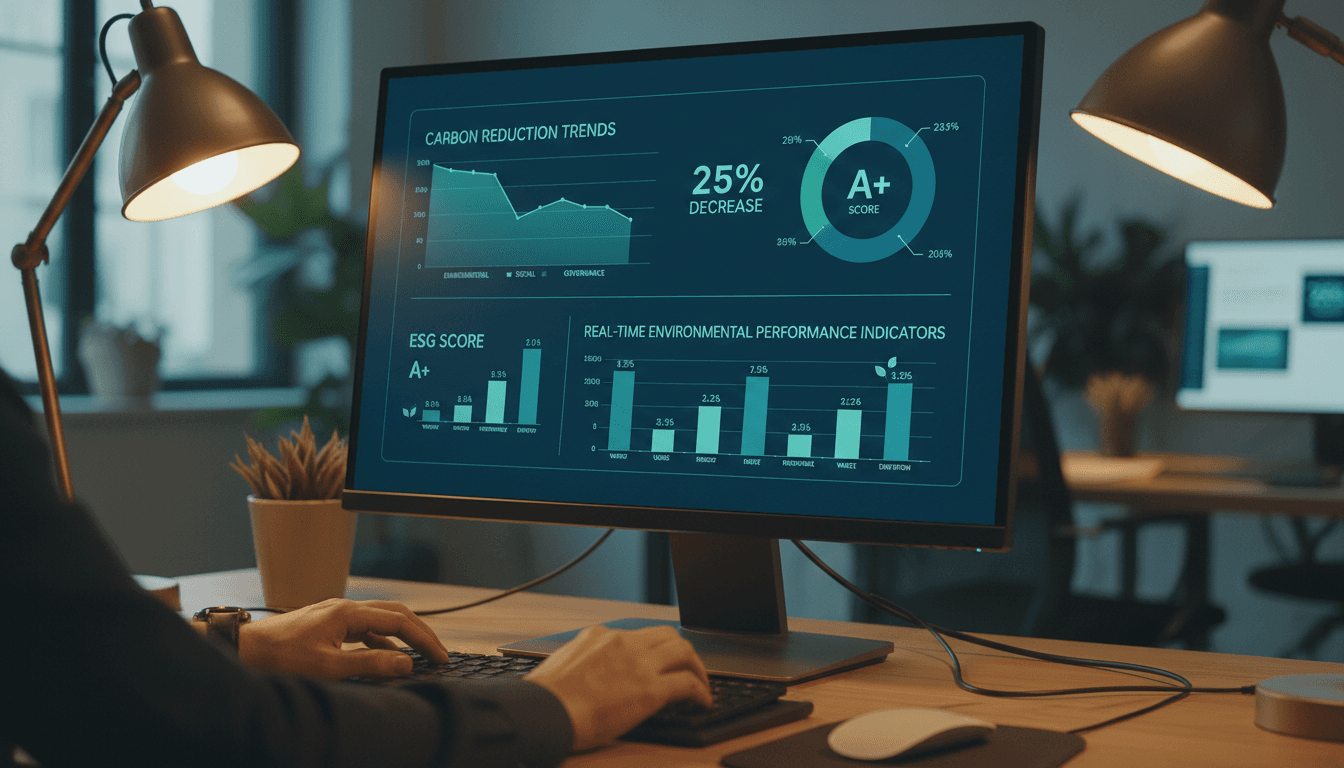

Carbon neutrality as core metric

All Veridian Global Investments portfolio companies achieve operational carbon neutrality or carbon-negative profiles with verified lifecycle emission reductions.

Regulatory alignment & tailwinds

We target businesses positioned within EU Green Deal, Fit-for-55, CBAM, U.S. IRA, and LatAm climate frameworks for sustained growth.

Institutional-grade capital

We combine hands-on industrial development expertise with structured, professional capital for platform scaling across Europe, the U.S., and Latin America.

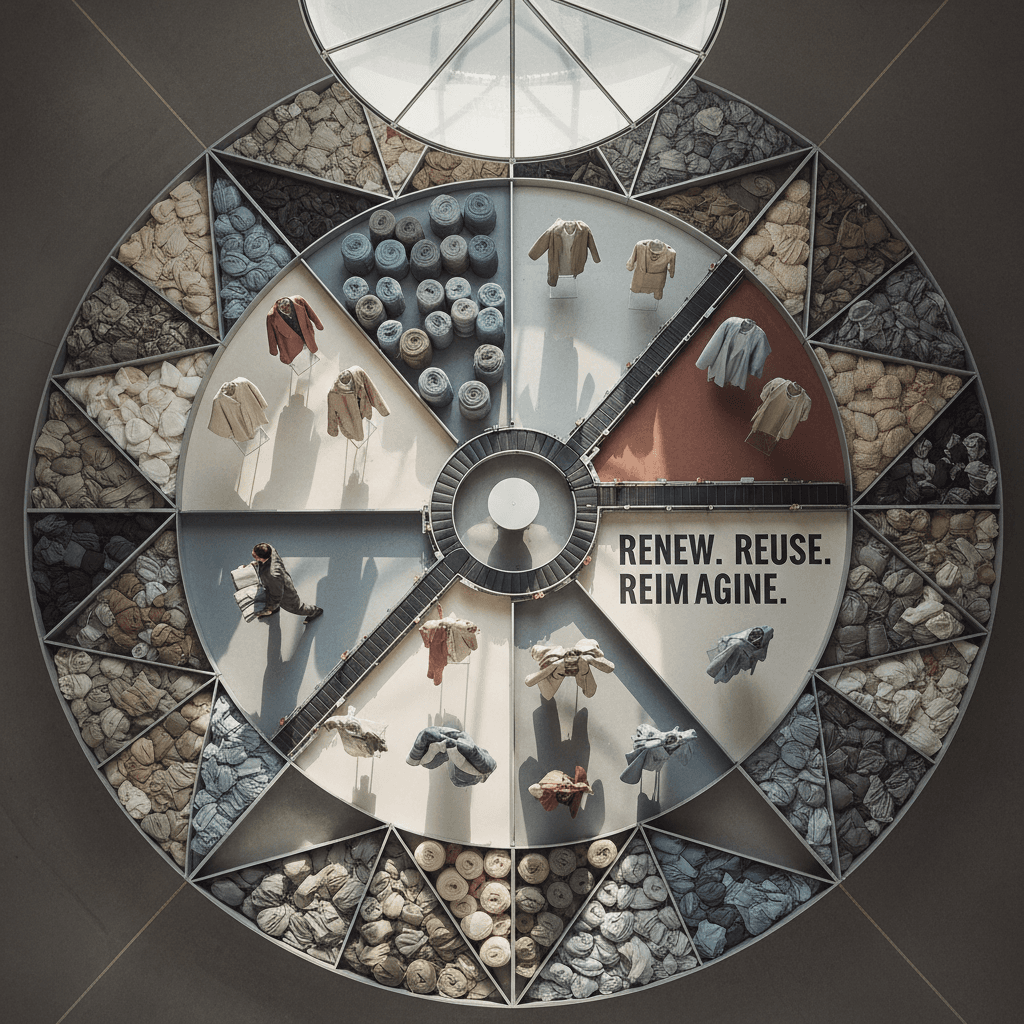

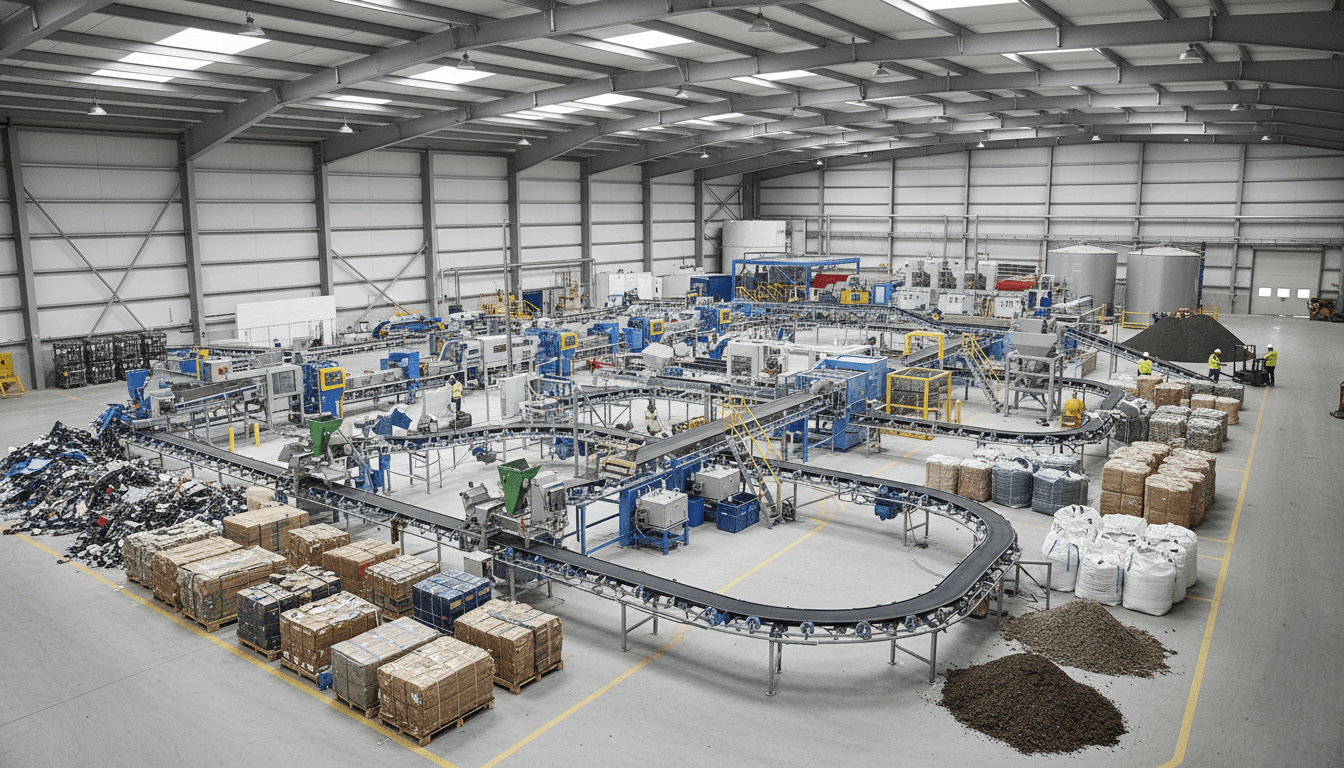

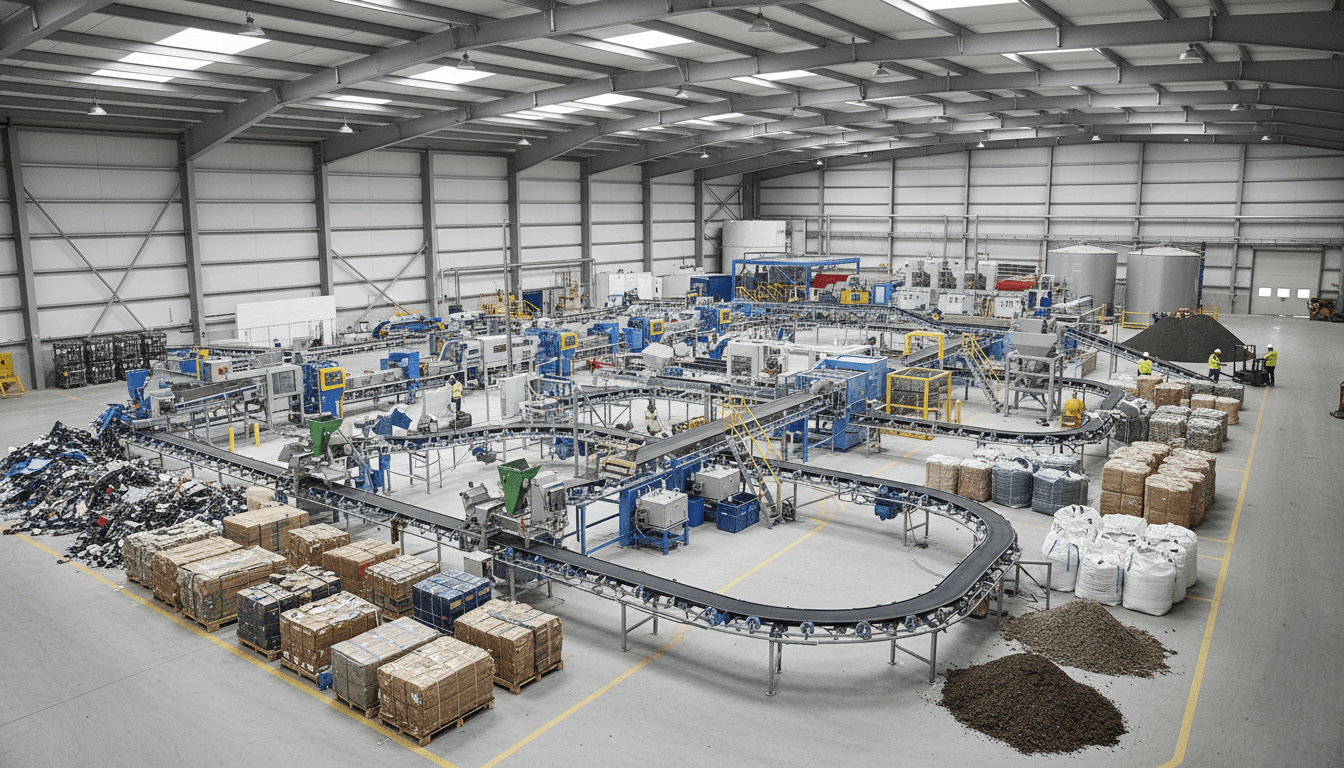

Circular economy focus

Advanced recycling, waste-to-value, sustainable agriculture, and carbon-negative processes aligned with global climate commitments.

Why Leading Industrial Platforms Choose Veridian

Our partners benefit from institutional capital, hands-on development expertise, and alignment with global climate frameworks.

Veridian provided more than capital. They brought operational depth and strategic clarity to scale our circular economy platform across three countries.

Carlos Fernández

Founder & CEO, Advanced Materials Platform

Their understanding of EU regulatory frameworks and carbon-neutral requirements shaped our entire go-to-market strategy. It's rare to find advisors with real platform-building experience.

Sophie Dubois

Managing Director, Renewable Fuels Division

Veridian didn't just evaluate our business. They helped us identify and solve structural challenges before they became scaling bottlenecks. That development expertise is invaluable.

Paulo Silva

CEO, Sustainable Agriculture Platform

We evaluated several investment partners, but Veridian was the only one who understood our carbon-negative pathway and how to structure it for long-term value creation.

Elena Rossi

Founder, Decarbonized Infrastructure Solutions

The difference is in the follow-through. Veridian stays engaged post-investment, helping us navigate regulatory changes and identify bolt-on acquisition opportunities aligned with our climate goals.

Marcus Okonkwo

COO, Advanced Recycling Platform

Veridian combines the rigor of institutional banking with the hands-on problem-solving of operating partners. That combination is exactly growth platforms need to scale responsibly.

Michiel Wijnans

CFO, Van Schaften Group

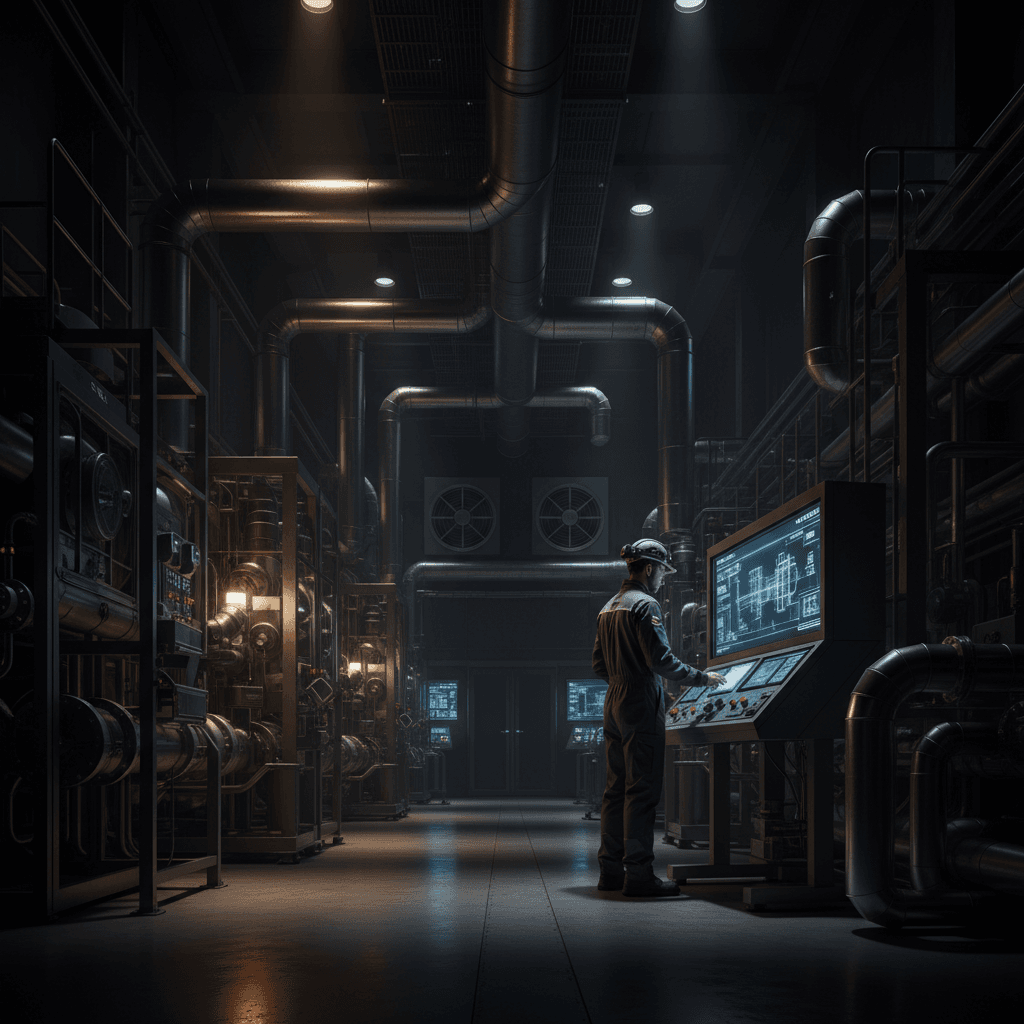

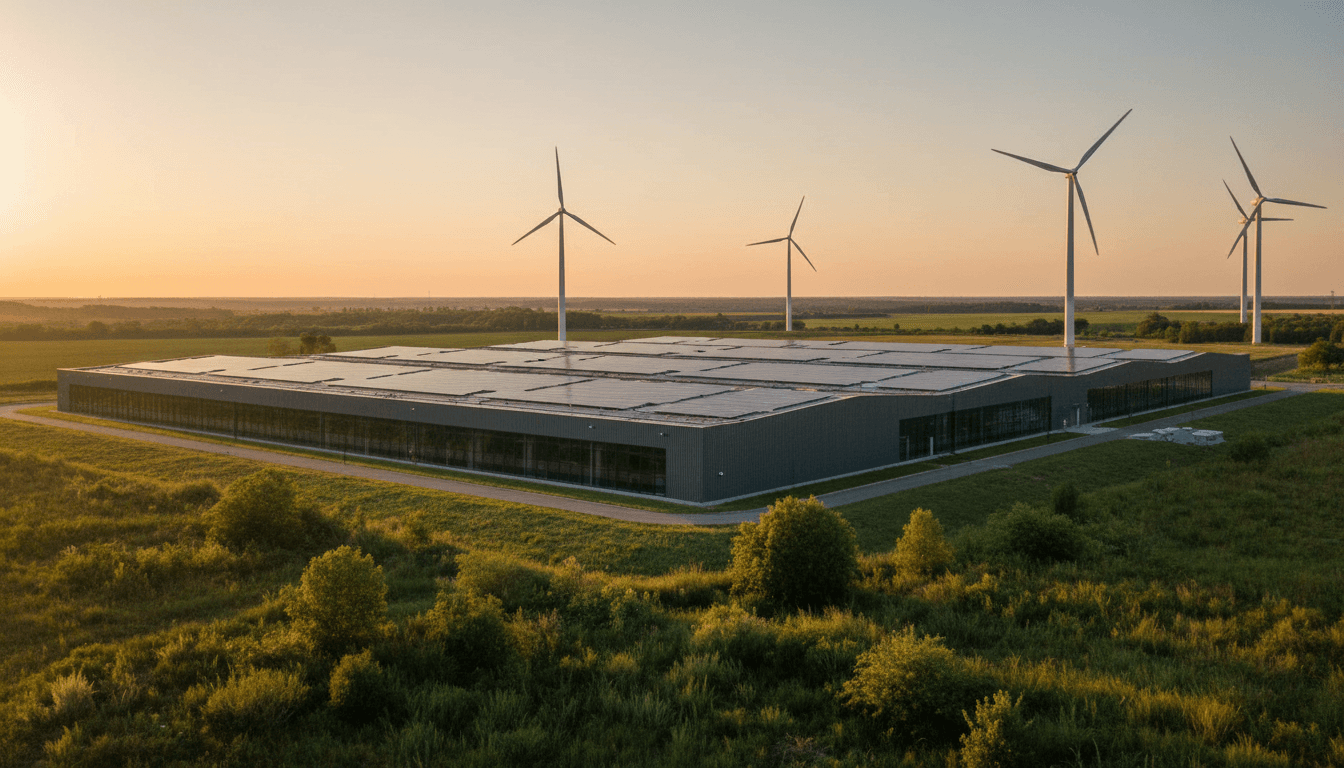

Building carbon-neutral industrial platforms at scale

Veridian Global Investments LLC combines institutional-grade capital with hands-on development expertise to create measurable environmental and financial returns across three continents.

3

Core geographies

Europe, United States, and Latin America with Spain as our operational hub.

6

Investment sectors

Circular economy, advanced recycling, decarbonized infrastructure, sustainable agriculture, carbon-negative processes, and renewable fuels.

100%

Carbon neutrality

Every portfolio company structured to achieve operational carbon neutrality or carbon-negative profiles.

EU

Framework aligned

Investments structured for compliance with Green Deal, Fit-for-55, CBAM, U.S. IRA, and LatAm climate targets.

Let's build carbon-neutral platforms together.

Explore how Veridian Global Investments can accelerate your impact-driven business across Europe, the US, and Latin America.

Carbon-neutral platforms driving real impact

See how our portfolio companies are transforming industries across circular economy, advanced recycling, decarbonized infrastructure, and sustainable agriculture.