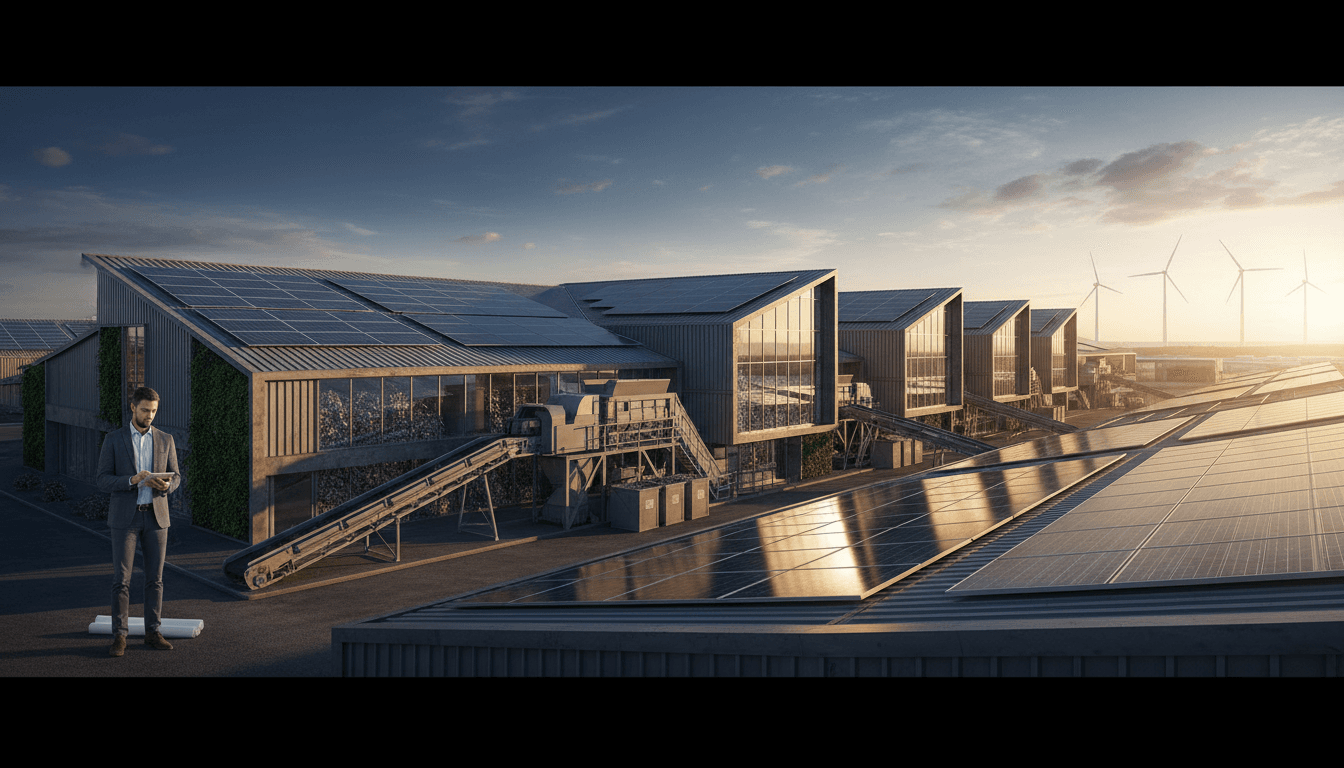

Building sustainable industrial platforms that matter

We pair institutional capital with hands-on development expertise to create and scale businesses in circular economy, advanced recycling, decarbonized infrastructure, and renewable energy across Europe, the US, and Latin America.

Investment Banking for Carbon-Neutral Industrial Platforms

We build and scale transformative businesses across circular economy, advanced recycling, decarbonized infrastructure, and renewable fuels, combining institutional capital with hands-on development expertise.

Build, Scale, and Finance Your Platform

We combine capital structuring with hands-on expertise to help founders and management teams execute M&A, raise growth capital, and scale carbon-neutral industrial platforms across Europe, the US, and Latin America.

Mergers & Acquisitions

We structure and execute M&A transactions for platforms in circular economy, advanced recycling, and decarbonized infrastructure. We handle deal sourcing, valuation, negotiation, and integration planning.

Capital Raising

We design and execute capital raises for platforms targeting EU climate frameworks and global sustainability mandates. We manage investor relations, term sheet negotiation, and closing logistics for equity and structured debt.

Strategic Advisory

We advise boards and management on platform strategy, sustainability positioning, regulatory alignment, and market expansion across the EU, US, and LatAm. We bring institutional-grade capital market perspective to your decision making.

Platform Development

Beyond capital and deal execution, we actively develop platforms through operational improvement, market expansion, and technology integration. We bring hands-on development expertise to every investment.

Sustainability Structuring

We design investment structures that align with EU climate mandates (Green Deal, Fit-for-55, CBAM), US IRA incentives, and LatAm frameworks. We ensure every platform achieves measurable carbon-neutral or carbon-negative outcomes.

Regulatory Alignment

We navigate complex climate and industrial regulations across jurisdictions. We structure platforms to capture regulatory tailwinds and maintain compliance with evolving carbon, circular economy, and ESG standards.

Advisory Services Built for Carbon-Neutral Growth

We guide industrial platforms through strategy, sustainability integration, and operational scaling. Our advisory approach combines regulatory expertise with hands-on industrial development to help you build durable, carbon-neutral businesses aligned with EU and global climate frameworks.

Platform Builders Trust Veridian's Approach

Entrepreneurs and industrial operators across Europe, the U.S., and Latin America have scaled their carbon-neutral platforms with our capital and hands-on expertise.

Veridian brought more than capital. They understood our circular economy model, connected us with operational expertise, and moved fast. We closed funding in 6 months.

Sofia Martínez

Founder & CEO, Advanced Recycling Platform

What impressed us most was Veridian's deep understanding of EU climate frameworks and how they aligned our business model with long-term regulatory trends. Strategic guidance that paid off.

Henrik Larsson

COO, Decarbonized Infrastructure Group

Veridian didn't just fund us. They helped us think bigger about platform scalability and carbon-neutral operations. The hands-on development support was invaluable.

Carlos Mendoza

President, Sustainable Agriculture Holdings

The team at Veridian speaks both financial and operational language. They structured a deal that made sense for growth and impact. That's rare.

Anna Klein

Managing Director, Renewable Fuels Coalition

We needed partners who understood both climate impact metrics and cash flow. Veridian delivered on both. Their platform approach forced us to think systemically.

Rafael Santos

Founder, Advanced Materials Venture

Access to institutional-grade capital is one thing. Access to a team that rolls up their sleeves and helps you build is another. Veridian is the latter.

Isabelle Rousseau

CEO, Circular Economy Solutions Europe

Built on impact. Proven across regions.

We combine institutional-grade capital with hands-on development expertise to create and scale carbon-neutral industrial platforms.

3

Core geographic markets

Active investment and development across Europe, the United States, and Latin America.

6

Industry sectors

Circular economy, advanced recycling, decarbonized infrastructure, sustainable agriculture, renewable fuels, and advanced materials.

EU

Regulatory alignment

All platforms structured to meet Green Deal, Fit-for-55, CBAM, and IRA frameworks.

100%

Carbon neutrality focus

Every portfolio company designed to achieve operational carbon neutrality or carbon-negative outcomes.

Ready to build impact? Let's talk.

Connect with our team to explore how Veridian Global can structure your carbon-neutral platform or scale your sustainable business.