Building Carbon-Neutral Industrial Champions

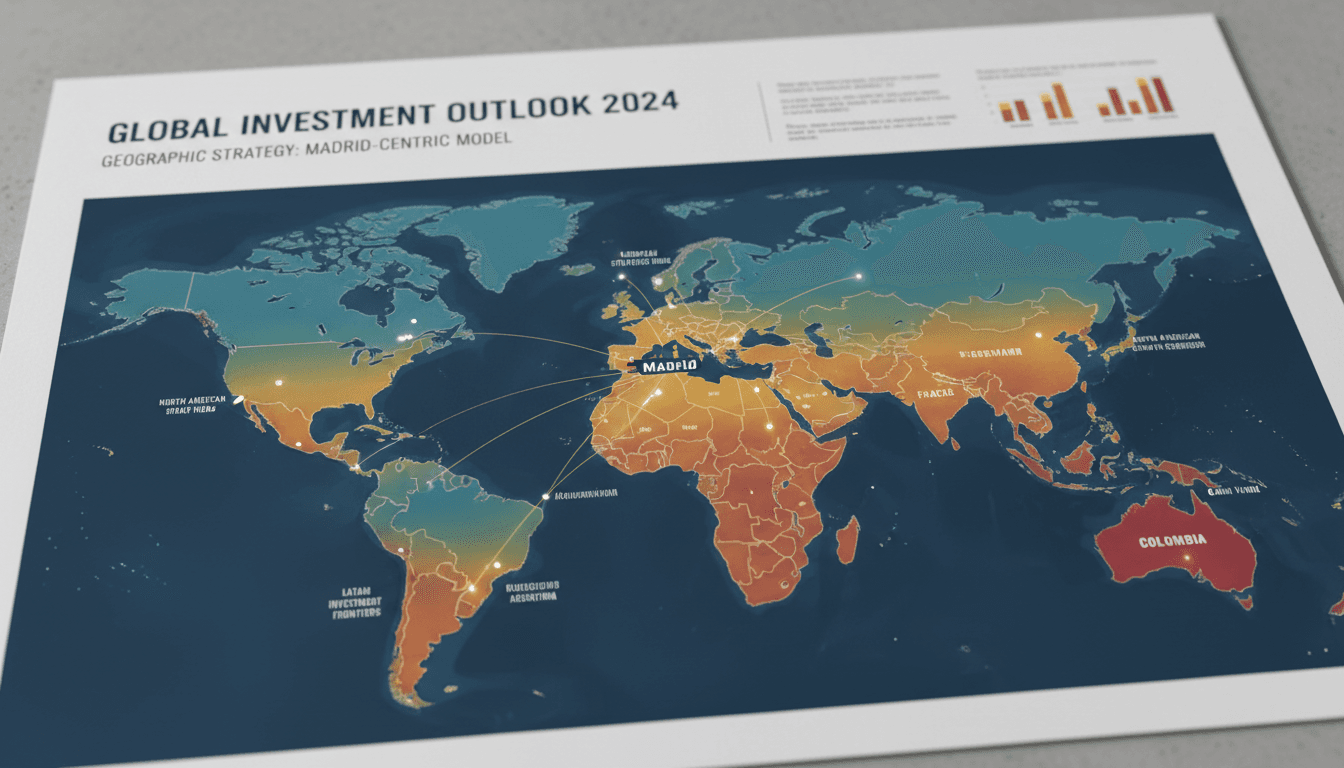

We're an impact investment boutique creating and scaling transformative platforms across Europe, the United States, and Latin America.

Building platforms that deliver impact and returns

We create carbon-neutral industrial businesses that generate strong cash flows while advancing Europe's climate goals. Real assets. Measurable outcomes. Long-term value.

Hands-On Expertise Building Climate Impact

Our team combines institutional investment experience with deep operational expertise in building carbon-neutral platforms across Europe, the US, and Latin America.

Founder and Managing Partner

Javier Anglada

Javier leads Veridian's investment thesis and platform development strategy. His background spans institutional capital structuring, industrial operations, and climate-aligned infrastructure across three continents.

Vice President of Portfolio Development

María Catalán

María identifies and structures platform opportunities in circular economy and advanced materials. She brings expertise in EU regulatory frameworks and hands-on experience scaling industrial platforms.

Platform-Centric Investing for Real Impact

We build scalable industrial platforms with contracted revenues, regulatory tailwinds, and verified carbon outcomes across Europe, the US, and Latin America.

Platform-First Approach

We invest in scalable operating businesses, not isolated assets. Each investment is built to generate strong recurring revenues with measurable environmental impact.

Real Assets, Real Returns

Asset-backed infrastructure investments with contracted revenue models aligned to EU Green Deal, CBAM, U.S. IRA, and LatAm climate frameworks.

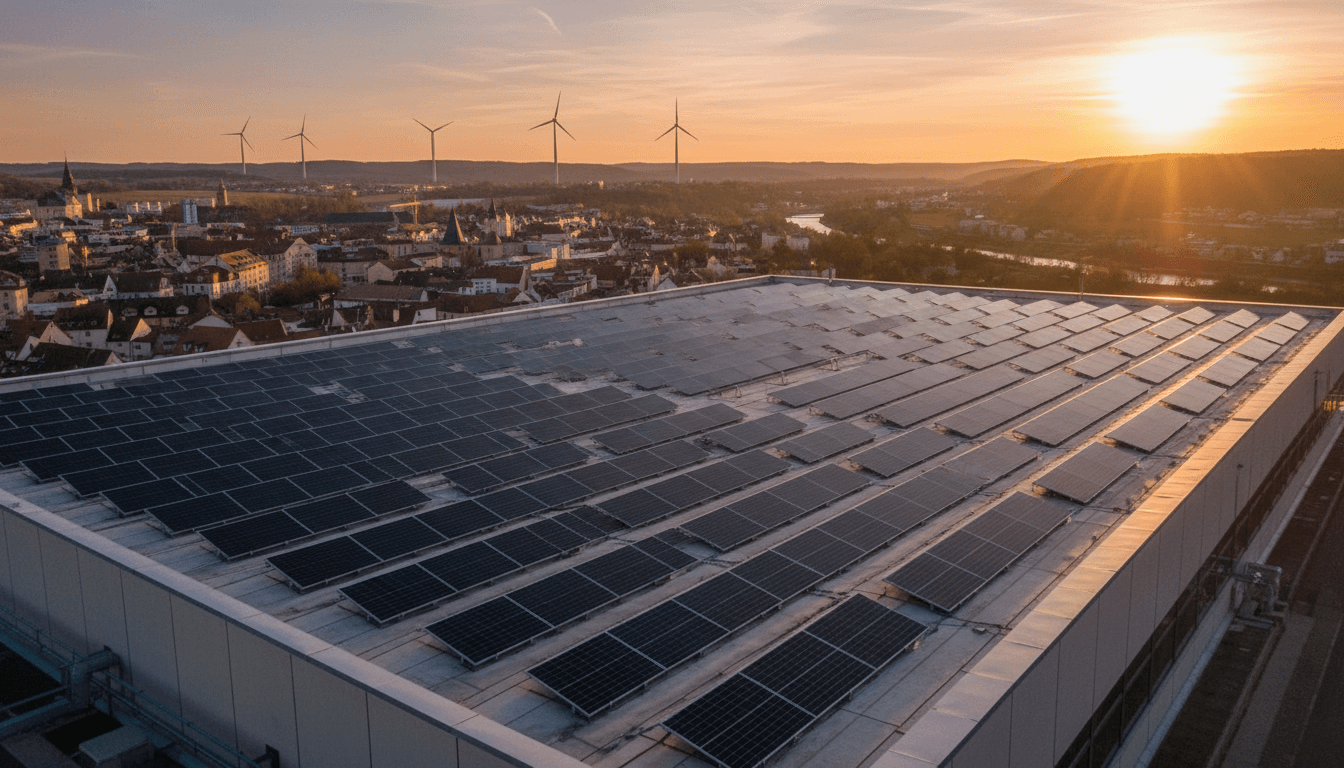

Carbon Neutrality by Design

All portfolio companies achieve operational carbon neutrality or carbon-negative profiles with verified lifecycle emission reductions aligned to net-zero targets.

Institutional Capital + Development Expertise

Veridian Global combines institutional-grade capital structuring with hands-on industrial development experience to build market-leading platforms.

Strategic Geographic Focus

Spain serves as our anchor market gateway, leveraging strong renewable penetration, EU regulatory tailwinds, and critical circular-economy infrastructure gaps.

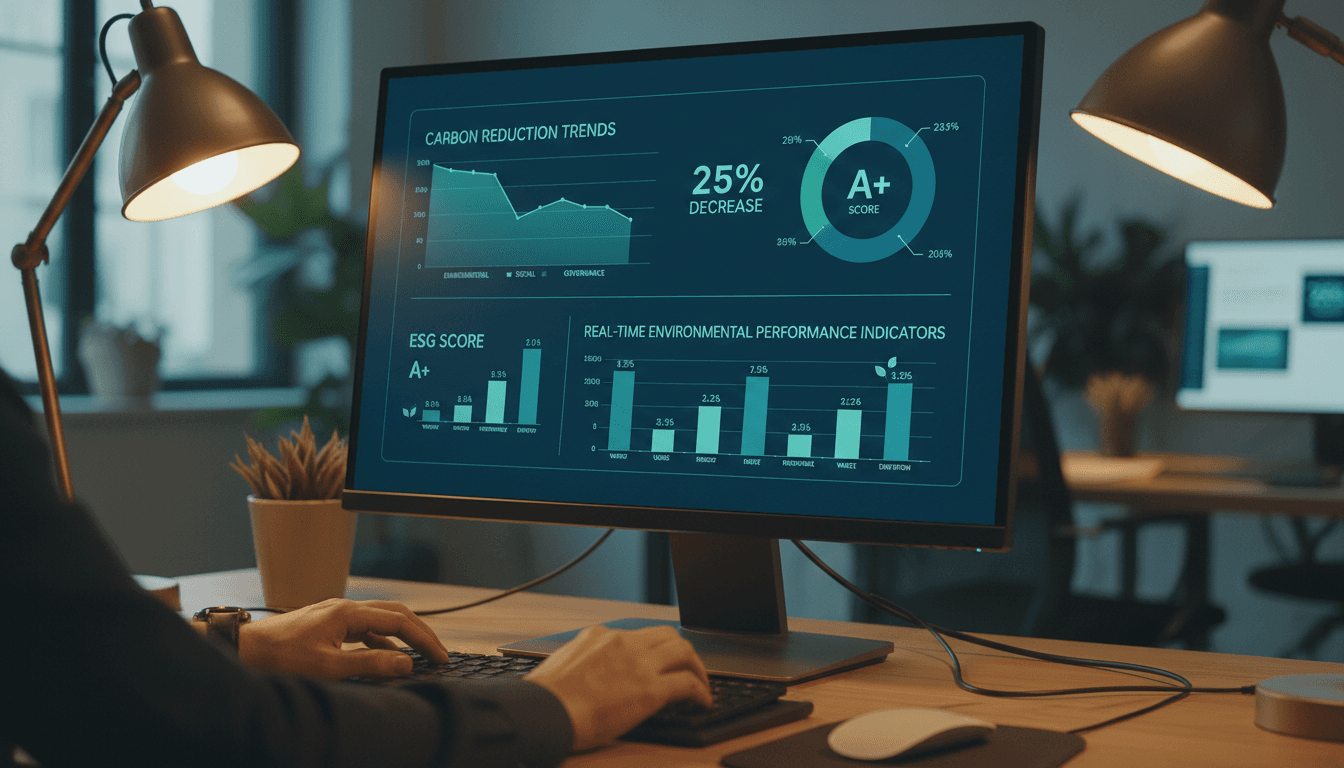

Measurable ESG & Impact Reporting

Transparent tracking of environmental outcomes, ESG metrics, and carbon reduction across our entire portfolio with verified third-party reporting.

Questions about our approach

Find answers to what sets Veridian Global Investments LLC apart in sustainable industrial investing.

What makes your platform-centric approach different?

We build scalable operating businesses, not isolated assets. Each investment is structured for recurring revenues, regulatory alignment, and measurable environmental impact from day one. This means our portfolio companies become market leaders, not passive holdings.

How do you ensure carbon neutrality across your portfolio?

All portfolio companies are structured to achieve operational carbon neutrality or carbon-negative profiles. We verify lifecycle emission reductions and align long-term operations with net-zero targets. This isn't a reporting exercise—it's embedded in how we build businesses.

What sectors does Veridian Global Investments LLC focus on?

We invest across circular economy, advanced recycling, decarbonized infrastructure, sustainable agriculture, carbon-negative processes, renewable fuels, and advanced materials. Each sector aligns with EU frameworks like the Green Deal and Fit-for-55, plus U.S. and LatAm climate incentives.

Why Spain as your initial anchor market?

Spain offers strong renewable energy infrastructure, EU regulatory tailwinds, industrial decarbonization incentives, and significant circular economy gaps—especially in plastics and biomass. It's the ideal gateway to scale platforms across Europe.

Do you provide hands-on support beyond capital?

Yes. We combine institutional-grade capital structuring with hands-on development expertise. Our team actively supports portfolio companies with operational scaling, market access, and regulatory navigation, not just financial oversight.

What are your investment criteria for new opportunities?

We look for asset-backed investments with contracted or quasi-contracted revenue models, clear regulatory alignment, tangible carbon reduction outcomes, and measurable ESG metrics. The opportunity must support our mission to build carbon-neutral industrial champions.

Ready to explore partnership?

Connect with our team to discuss how Veridian Global Investments LLC can support your sustainable industrial platform.